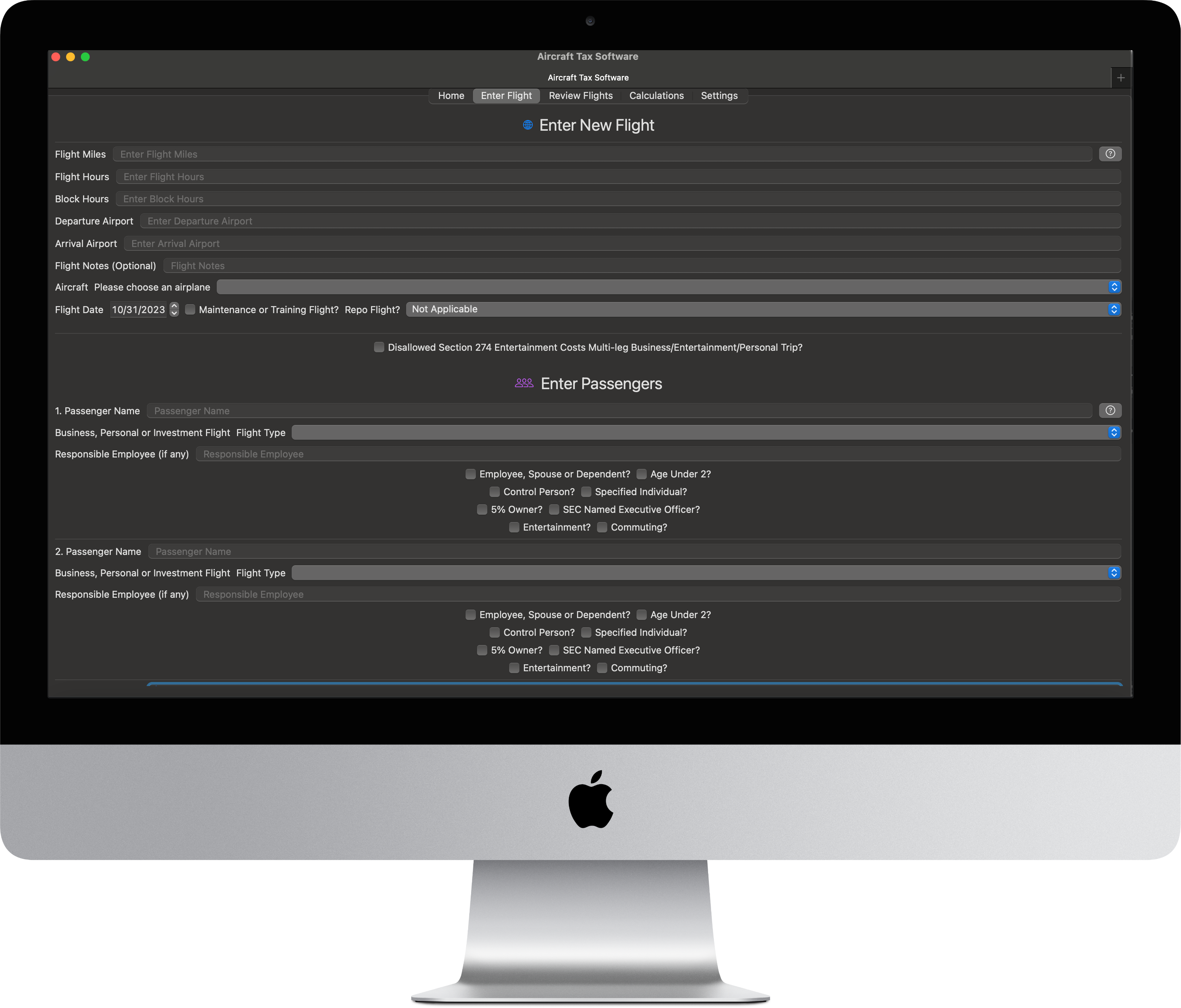

Track your flights for tax and SEC purposes.

The AircraftTaxSolutions.com software will track personal, entertainment, commuting and business flight hours and miles to compute IRC Section 280F Qualified Business Use percentages, SIFL imputed income amounts,

IRC Section 274 entertainment and commuting expense disallowance amounts, International travel apportionments and SEC Incremental Costs.

Multi-leg flight and Repositioning flight tracking supported.

Complete software flight package for tax and SEC Aircraft tracking and compliance reporting.

Sign up for free 60-day trial (no credit card or commitment required).

Both Web based and MacOS/iOS versions available. All versions (web, Mac, iPhone and iPad) available with a single

subscription.