Section 280F Basics -- Qualified Business Use

In order to be able to claim bonus depreciation in the year of aircraft purchase or Modified Accelerated Cost Recovery System ("MACRS") accelerated depreciation for an aircraft, an aircraft must predominantly be used in a qualified business use for any taxable year as determined under Internal Revenue Code 280F. IRC § 280(b)(3). Similar rules apply to expensing the cost of aircraft under Section 179 of the Internal Revenue Code. See IRC § 280(d)(1). Property is predominantly used in a qualified business use for a year if the business use percentage is greater than 50 percent. Furthermore, if the 50% qualified business use test is met in the year of aircraft acquisition so that bonus depreciation may be claimed and accelerated depreciation methods used, if the 50% qualified business use test is not met in subsequent years, the aircraft must change to straight line depreciation under the alternative depreciation system ("ADS") and recapture (include in gross income) some of the depreciation previously claimed. IRC § 280F(b). If the qualified business use test is met and the aircraft is flown under FAR Part 91, the aircraft can generally be depreciated under MACRS over a period of five (5) years or by using ADS with a six (6) year recovery period. If the aircraft is used in commercial activities or carrying passengers or freight under FAR Part 135, the aircraft would instead generally be depreciated under MACRS over a seven (7) year recovery period or under ADS using a twelve (12) year recovery period. In the event that an aircraft is flown under both Part 91 and Part 135, the depreciation period applicable to the use which predominates will apply. Reg. § 1.167(a)-11(b)(4)(iii)(b)

With regard to aircraft, Congress sought to limit the use of accelerated and bonus depreciation for such aircraft where there is excessive personal use by business owners and their employees. The Joint Committee on Taxation explained that Congress was concerned about the use of accelerated and bonus depreciation with respect to property used primarily for personal or investment use rather than in the conduct of a trade or business, and that the incentive of accelerated and bonus depreciation was not designed to subsidize the purchase of aircraft that is used incidentally or occasionally in the taxpayer's business. Joint Committee on Taxation Staff, General Explanation of the Revenue Provisions of the Deficit Reduction Act of 1984, 98th Cong., 2d Sess. 559 (1984).

Only Business Use Counts as Qualified Business Use under Internal Revenue Code Section 280F.

The Section 280F test is based solely on business use. Investment use does not count. See Treasury Regulation § 1.280F-6(d)(2). However, investment use is only ignored for testing qualified business use. If it is determined that the 50% qualified business use test is satisfied for a given tax year, both business and investment use may be used to determine what portion of the expenses of the aircraft may be deducted (although the deduction of investment expenses is limited). When a trip involves both business and personal elements, it can often times be difficult to determine with conviction whether the trip is a business or personal trip. Under section 1.162-2(b)(1) of the IRS regulations, if a taxpayer travels to a destination and while at such destination engages in both business and personal activities, traveling expenses to and from such destination are deductible (and the trip is classified as business) only if the trip is related primarily to the taxpayer's trade or business. If the trip is primarily personal in nature, the traveling expenses to and from the destination are not deductible (and the trip is classified as personal) even though the taxpayer engages in business activities while at such destination. However, expenses while at the destination that are properly allocable to the taxpayer's trade or business are deductible even though the traveling expenses to and from the destination are not deductible. Section 1.162-2(b)(2) of the IRS regulations provides that whether a trip is related primarily to the taxpayer's trade or business (and hence a business trip) or is primarily personal in nature depends upon the facts and circumstances in each case. The amount of time during the period of the trip that is spent on personal activities compared to the amount of time spent on activities directly relating to the taxpayer's trade or business is an important factor in determining whether the trip is primarily personal. See IRS Rev. Rul 84-55. Hence, if a taxpayer engages in a business meeting or two while on vacation, this is not likely to convert the trip into a business trip for Section 280F purposes, particularly if there are non-business passengers accompanying the taxpayer (such as spouse, children, friends, etc...) and the majority of the time is spent on personal activities. At times, these determinations can be particuarly difficult.

Special Rules and Exclusion for Use By Five Percent Owner of Employer Provided Aircraft

The term “qualified business use” shall not include (I) leasing property to any 5-percent owner or related person, (II) use of property provided as compensation for the performance of services by a 5-percent owner or related person, or (III) use of property provided as compensation for the performance of services by any person not described in subclause (II) unless an amount is included in the gross income of such person with respect to such use, and, where required, there was withholding of tax as required under the Internal Revenue Code. This exclusion can make it hard to meet the greater than 50% qualified business use percentage since personal flights provided aircraft, including employer provided aircraft, will not count as qualified busines use even if SIFL income is imputed to the employee for such personal use. Note that personal use by non-five percent owners can count as qualified business use when such personal use is provided by an employer provided that such use is reported as income (presumably under the SIFL rules) and appropriate payroll withholding occurs. Note that this set of exclusions does not apply with respect to any aircraft if at least 25 percent of the total use of the aircraft during the taxable year consists of qualified business use not described in the 3 exclusions listed.

Business Entertainment Flights as Qualified Business Use

At one time, a distinction was drawn between business entertainment (that could be deducted) and personal entertainment (which could not be deducted). However, after passage of the Tax Cuts and Jobs Act in 2017, all entertainment expenses became non-deductible. IRC § 274. The Section 280F regulations include language suggesting that any entertainment use of an aircraft, to the extent the deduction of the related expenses are disallowed under Section 274, is not treated as business use. Treas. Reg. § 1.280-F(d)(3)(ii). Whether this means that business entertainment flights cannot count as qualified business use is unclear.

Related Party Leases -- Potential Trap for the Unwary

In certain instances, a taxpayer may arrange for an aircraft to be owned by one entity (often a single member limited liability company or corporation) and leased to an affiliate (sometimes an operating entity). Common sense would suggest that the same rules applicable to employer provided aircraft and directly owned aircraft would apply. In an attempt to accomplish this, Section 280F provides that the term “qualified business use” shall not include leasing an aircraft to any 5-percent owner or related person. IRC § 280F(d)(6)(C). Treasury Regulation Section 1.280F-6T(d)(2)(ii) clarifies this by specifying that the exclusion is applicable only to the extent that use of the property is by an individual who is a related party or 5-percent owner of the owner or lessee of the property. This prevents, for example, a taxpayer from leasing an aircraft to an affiliate and treating all personal and entertainment flights as qualfied business use on the basis that the aircraft owner leases the aircraft 100% of the time. Unfortunately, the IRS has taken the position that this rule prevents business flights by a 5% owner on the leased aircraft from being treated as qualified business use. TAM 200945037; see also DiDonato v. Commissioner, T.C. Memo. 2013-11 (following TAM 200945037); TAM 9217006 (permitting business use of leased aircraft by non-5% owner to be treated as qualified business use; business use by 5% owner not treated as qualified business use). The aircraft industry has objected to this position and the matter is now under study by the IRS. Unfortunately, this issue was surfaced many years ago and the IRS has not yet provided any guidance beyond that cited.

Employer Provided Aircraft vs. Direct Ownership

The rules under Section 280F are different depending on whether the taxpayer directly owns the aircraft (including ownership through 100% owned disregarded entities (single member land trust, titling trust, etc...)) or whether an employer entity owns the aircraft (in which case the special rules for employer provided aircraft described above apply). In the case of a directly owned aircraft, the special rules for 5% owners and the 25% threshold do not apply. Instead, the 50% qualified business use test is generally applied solely based on the purpose of each flight and each passenger. However, in situations where there are business passengers and non-business passengers on the flight, there is an absence of clear guidance on how the Section 280F tests should be applied and different approaches have to be considered (which are beyond the scope of this discussion).

Lease to Unrelated Part 135 Charter Company

Many aircraft owners may seek to increase the use of their aircraft and generate some revenue by placing management of their aircraft with an unrelated Part 135 charter company. This can permit the charter company to charter the aircraft out to third parties when the owner is not using it and arrange the owner's flights. The structures can be established as management agreements and arrangements, dry leases or a combination thereof. In the lease structure, if the lease provides that owner use is provided by the charter company for a charter fee and the charter company is using the aircraft under the lease to provide the flight then all use should be treated as qualified business use under the 25% and 50% business use tests. In fact, Section 280F provides that the limitations of Section 280F do "not apply to any [aircraft] leased or held for leasing by any person regularly engaged in the business of leasing such property." See IRS § 280F(c)(1) Section 1.280F-5T(c) of the regulations states that a person shall be considered regularly engaged in the business of leasing aircraft only if contracts to lease such property are entered into with some frequency over a continuous period of time. The determination shall be made on the basis of the facts and circumstances in each case, taking into account the nature of the person's business in its entirety. Occasional or incidental leasing activity is insufficient. For example, a person leasing only one aircraft during a taxable year is not regularly engaged in the business of leasing aircraft. In addition, an employer that allows an employee to use the employer's aircraft for personal purposes and charges the employee for the use of the property is not regularly engaged in the business of leasing with respect to the aircraft used by the employee. In the case of a management arrangement or if the legal documents provide that the lease is not-exclusive and the owner provided flights are provided on a management basis, then the regular rules described here should apply to those flights (although the third party charter flights should assist in meeting the 25% and 50% qualfied business use tests).

Possible Methods to Calculate Qualified Business Use

The Regulations governing entertainment expense disallowance permit the computation of the disallowance percentages for entertainment use under 4 methods: Flight by flight hours, flight by flight miles, occupied seat miles and occupied seat hours. See Treas. Reg. § 1.274-10. There are no formal rules on how to determine qualified business use, although IRS has indicated informally that taxpayers could use the occupied seat methods provided under the entertainment expense disallowance regulations to test whether the 50% qualified business use test is met. TAM 200945037. Many professionals believe that the flight by flight methods set forth in the entertainment expense disallowance regulations should also be able to be applied in determining whether the qualfiied business use test is satisfied in any given year. Recently, in internal IRS documents released pursuant to freedom of information act requests, the IRS appeared to permit the use of any of the 4 methods used under the entertainment expense disallowance regulations, including the flight by flight methods, to be used for determined qualified business use under Section 280F. See IDR 1 and IDR 2. The occupied seat hours and occupied seat miles methods determine the amount of expenses allocated to a particular flight of an individual based on the occupied seat hours or miles for an aircraft for the taxable year. This method makes the determination on a passenger by passenger basis. The flight-by-flight method determines the amount of expenses allocated to a particular flight of an individual on a flight-by-flight basis by allocating expenses to individual flights and then to an individual traveling on that flight. These methods are further adjusted to provide that empty or deadhead flights are characterized based on the flight to which they are associated (for example, an empty flight to pick up passengers for a non-business flight home would be treated as a non-business trip with the same passengers traveling for the same purposes). In addition, special rules also exist for multi-leg flights that have business and entertainment legs. The Aircraft Tax Solutions software computes business use percentages for Internal Revenue Code Section 280F qualified business use testing under each of the 4 methods.

Examples

Example 1 -- Occupied Seat Method -- Hours. A taxpayer-provided aircraft is used for a 4 hour flight from Atlanta to Los Angeles and back two days later. Each flight carries four passengers. Two of the passengers are flying for business purposes and two of the passengers are traveling for personal purposes. The aircraft is operated for 32 occupied seat hours for the period (four passengers times 4 hours (16 occupied seat hours) for the flight to Los Angeles plus four passengers times 4 hours (16 occupied seat hours) for the return flight). For testing purposes, under the occupied seat method using hours, exactly 50% of the use is qualified business use (2 business passengers on flight to Los Angeles multiplied by 4 hours and 2 business passengers on the return flight times 4 hours). For purposes of Section 280F, an aircraft is treated as predominantly used in a qualified business use for any taxable year only if the business use percentage for such taxable year exceeds 50 percent. Hence, these flights are unhelpful in meeting the predominantly used in a qualified business use test but only by a fraction of a percent.

Example 2 -- Flight by Flight Method -- Miles. Assume a taxpayer-provided aircraft is used for two flights. A flight from Dallas, TX (DFW) to Los Angeles, CA (LAX) and a return flight. Assume the flight is 1,235 statute miles. Assume the flight to Los Angeles has 4 passengers, one traveling for business and 3 traveling for personal purposes. Assume on the return flight, only one passenger traveling for business is returning. Under the flight by flight method using miles, business use percentage would be calculated as follows. The flight to Los Angeles involves 308.75 business miles (1/4 * 1,235 miles). The return trip is comprised of 1,235 business miles since there is one business passenger. Hence, the business use percentage for these flights is 62.5% ((308.75 first trip business miles + 1,235 return trip business miles)/2,470 total miles).

Maintenance and Training Flights

There is limited guidance whether maintenance and training flights should be treated as business flights or ignored completely when testing under Section 280F. A recent U.S. Tax Court decision, Conrad vs. Commissioner, T.C. Memo. 2023-100, indicated that training flights would be treated as business use when the training was in furtherance of business activities. The IRS has indicated in a ruling that maintenance flights should not be classified as business flights since the maintenance relates to all categories of flights for the year. In one Tax Court case, Noyce vs. Commissioner, 97 T.C. 46 (1991), the Tax Court concluded that maintenance flights should be included in the denominator of the fraction used to determine depreciation allowed on an aircraft. In that case, however, no maintenance flights were included in the numerator because business operations had not commenced yet for the taxpayer. A reasonable implication from the case discussion however is that if business activities for the taxpayer had commenced and the aircraft had been used in furtherance of those activities, that the associated flight miles could be considered as business use and included in the numerator. The Aircraft Tax Solutions software computes business use percentages for both Section 280F qualified business use testing and Section 274 entertainment disallowance testing on multiple bases (including and excluding maintenance and training flights).

Burden of Proof is on Taxpayers

One of the more frustrating aspects of these determinations is that the burden of proof is on a taxpayer to establish that they satisfy the various qualified business use percentage tests under Section 280F. US Tax Court Rule 142; Bruns v. Commissioner, T.C. Memo. 2009-168 (the taxpayer claimed deductions for travel expenses related to trips having a mixed business and pleasure motivation. The court noted that on these trips, taxpayer visited friends and relatives who were also customers and distributors in the taxpayer’s business. Updating these customers and distributors about the new products and providing coaching on business leadership was business related. Visiting with friends and relatives about matters not related to the business was for pleasure. The court cited § 1.162-2(b)(1), (2) and (c), explaining that petitioners would be entitled to a deduction for expenses incurred at the location properly allocable to business activities. However, petitioners failed to provide sufficient information to allow any of the disallowed travel expenses). Even though the taxpayer may in fact meet the 25%/50% qualified business use percentages, unless the taxpayer can prove this with credible evidence, the taxpayer may not be able to establish that they have the requisite qualifed business use in a given tax year. Hence, taxpayer must maintain satisfactory records to avoid or at least reduce burden of proof problems with these matters. See also Lysford v. Commissioner, T.C. Memo. 2012-41 (taxpayer failed to maintain adequate records to support greater than 50% qualified business use to support Section 179 expensing of Cessna aircraft)

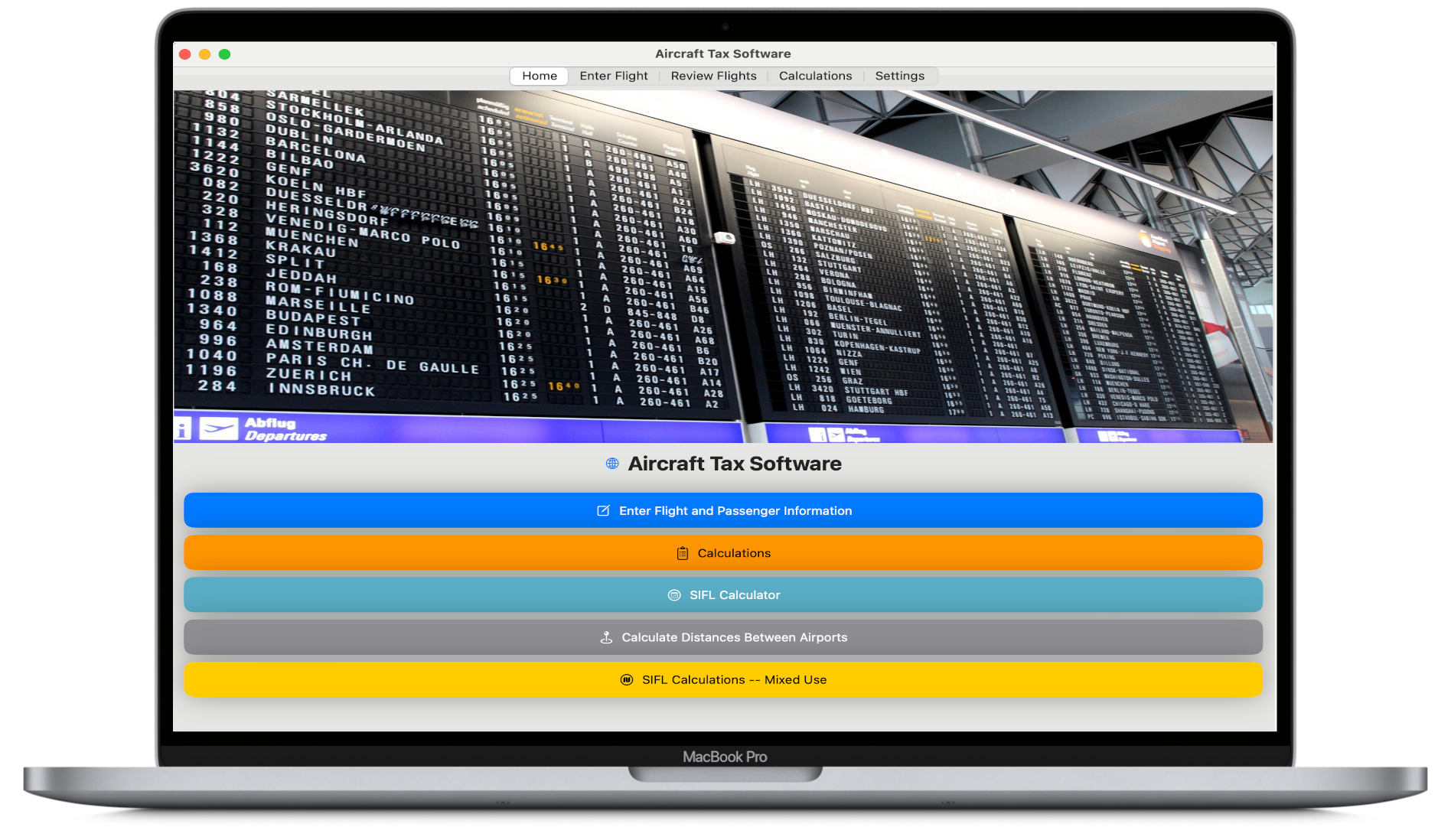

Sign Up for Free Trial of Aircraft Tax Software.

Signup for a free trial of the Aircraft Tax Software to track personal, entertainment, commuting and business flight hours and miles to compute Internal Revenue Code Section 280F Qualified Business Use percentages, Standard industry fare level (SIFL) imputed income amounts for personal use flights, IRC Section 274 entertainment and commuting expense disallowance amounts and SEC Incremental Costs for reporting for named executive officers. Track Internal Revenue Code Section 280F Qualified Business Use percentage thresholds which must be met or exceeded in the year of purchase to obtain bonus depreciation and to use accelerated depreciation methods, and must be met or exceeded in subsequent years to avoid depreciation recapture. Multi-leg entertainment flight tracking and calculation option included. Repositioning flights tracked. Complete flight package for tax and SEC Aircraft tracking and compliance reporting. Download logs for audit purposes and records.

Both Web based and MacOS/iOS versions available. All versions (web, Mac, iPhone and iPad) available with a single subscription. Download on the Mac App Store , on the iOS-iPhone App Store or signup for the web version. Sixty-day free trial available (no credit card or commitment required).

* AircraftTaxSolutions.com does not provide tax, legal or accounting advice. These materials have been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.