SEC Incremental Costs for Named Executive Officer Personal Use of Aircraft

SEC Incremental Cost Basics

The SEC requires publicly registered companies to report executive compensation. Item 402 of SEC Regulation S-K requires publicly registered companines to disclose in their proxy materials the total value of "executive compensation" for "named executive officers." Included in this reportable total value are perks and other personal benefits if they exceed certain levels. For this purpose, named executive officers means any Chief Executive Officer that served during the last completed fiscal year, any Chief Financial Officer that served during the last completed fiscal year, the next three most highly compensation executive officers at the end of the last completed fiscal year, and up to two additional individuals who would have been among the most three highly compensated executive officers had they been executive officers at the end of the previous fiscal year end. Disclosure of perks is also required for directors.

Permitting an officer to use a corporate aircraft for personal travel is generally the type of perk or personal benefit that is required to be disclosed under these rules. The SEC rules provide that “perquisites and other personal benefits shall be valued on the basis of the aggregate incremental cost to the registrant and its subsidiaries.” Little guidance is provided, however, as to how to determine the "aggregate incremental cost" of a flight. Also unclear is whether repositioning, empty or deadhead flights caused by personal travel should be included in determining the incremental cost for a flight, although to be safe, including the incremental costs of these flights seems like the prudent apprroach (and is consistent with some SEC statements and the practice of many issuers).

Fixed vs. Variable Costs

There is no clear guidance whether both fixed and variable costs have to be factored into determining the incremental costs of a personal flight, although it appears most issuers only factor in variable costs on the basis that most use is business related. However, even with this distinction, it is challenging to determine whether a variety of costs are fixed or variable. For example, is a major repair or major maintenance a variable or fixed cost? Often, we see the following items included within varable costs: fuel, landing/parking fees, crew fees and expenses, custom fees, flight services/charts, variable maintenance costs, inspections, catering, aircraft supplies, telephone usage, trip-related hangar rent and parking costs, plane repositioning costs (deadheadflights), occupied variable fees, and other miscellaneous expenses. In situations where a guest accompanies a business executive, there is arguably little or no incremental cost in most circumstances (aside from any additional catering costs).

Flight Hours vs Miles

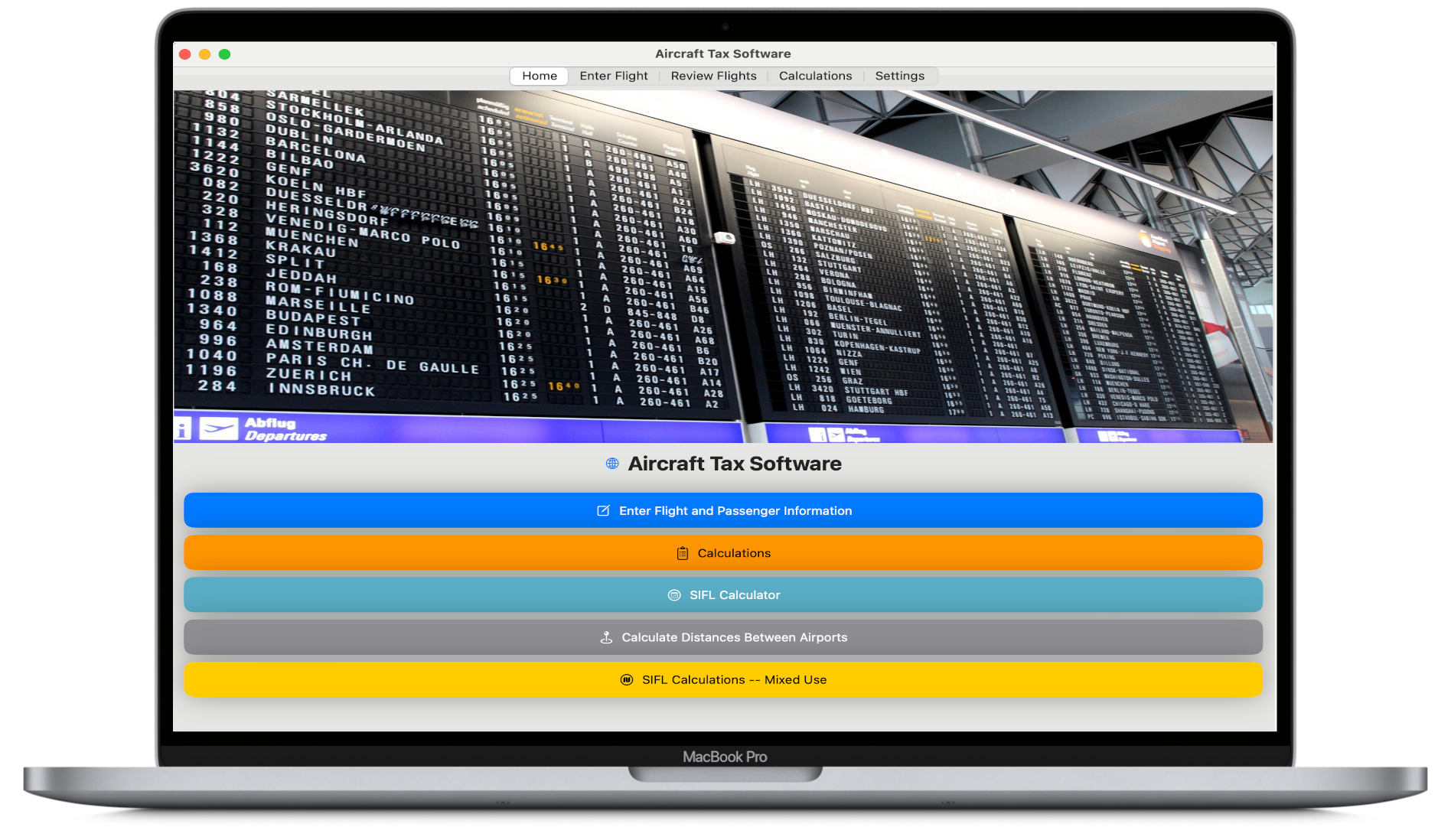

Although the IRS has prescribed detailed rules on using different approaches to determine the costs of personal flights, including hours, miles, flight by flight, occupied seat miles, no similar detailed guidance exists for determining the incremental costs for SEC reporting purposes. According to public proxies, it appears many issuers use a flight hours approach. Our comprehensive Aircraft Tax Software tracks personal use by a variety of methods, including flight hours, to simplify these calculations.

Time Sharing Agreements -- Reimbursements

In order to reduce the incidental benefits to an executive officer or director that would have be disclosed under Item 402 of SEC Regulation S-K, some issuers require the executive officer or director to reimburse the issuer for the incremental costs for any personal flights. To permit such reimbursements, the issuer and executive officer or director need to comply with FAA rules which impose limits on the amount of reimbursements and payments. See FAR 91.501 (Reimbursements are limited to the cost of these items for the flight: (1) Two times fuel, oil, lubricants, and other additives; (2) Travel expenses of the crew, including food, lodging, and ground transportation; (3) Hangar and tie-down costs away from the aircraft's base of operation; (4) Insurance obtained for the specific flight; (5) Landing fees, airport taxes, and similar assessments; (6) Customs, foreign permit, and similar fees directly related to the flight; (7) In flight food and beverages; (8) Passenger ground transportation; and (9) Flight planning and weather contract services). Typically, to comply with an exception allowing reimbursement, the issuer and executive officer will enter into a time sharing agreement (see linked example). The time sharing agreement must be entered into prior to any flights for which reimbursement is to be paid (no retroactivity is permitted). Note that the reimbursement may be subject to the 7.5% federal excise tax on the transportation of persons. See IRC § 4261. If no reimbursements are made, taxable income must generally be imputed to the executive officer or director either at a market charter rate or under the SIFL rules. Also, the time share rules generally can only be used for large (maximum certified takeoff weight of more than 12,500lbs) and turbojet-powered multi-engine civil airplanes of U.S. registry. Note, turbopropeller powered airplanes are not turbojet powered unless the turbopropeller powered airplanes are large (although limited exceptions exist). Outside of time sharing arrangements, there are only limited other options for certain officers to provide reimbursement under current FAA rules (Nichols Opinion permitting cost reimbursement for the pro-rata cost for flights by certain approved executives for routine personal travel).

SEC Enforcement Actions

The SEC continues to bring enforcement actions against companies for failing to disclose the value of personal flights on corporate aircraft. The SEC has even indicated that enforcement actions in this area have been generated by the SEC "Division of Enforcement’s use of risk-based data analytics to uncover potential violations related to corporate perquisites." See SEC Hilton Worldwide Press Release. Recently, the SEC Charged Stanley Black & Decker and a Former Executive for Failures in Executive Perks Disclosure (June 20, 2023). According to the SEC’s order against Stanley Black & Decker, the company failed to disclose at least $1.3 million worth of perquisites and personal benefits paid to, or on behalf of, four of its executive officers and one of its directors from 2017 through 2020. The perquisites predominantly consisted of expenses associated with the executives’ use of corporate aircraft. See also National Beverage SEC Order(settlement involving $481,920 penalty for reporting failures, including failure to disclose incremental costs of personal use of corporate aircraft by named executive officer); Greenbrier SEC Settlement (March 2, 2023) ($1,000,000 civil penalty, in part, for failure to fully disclose incremental costs of personal travel by named executive officers and in part because of failure to fully disclose that named executive officer received benefits from chartering personally owned aircraft to employer). Hilton Worldwide Holdings Inc. SEC Settlement and Order ($600,000 civil penalty for failure to properly disclose aircraft and hotel perks).

Sign Up For Free 60 Day Aircraft Tax Software Trial.

Signup for a free trial of the AircraftTaxSolutions.com Aircraft Tax Software to track personal, entertainment, commuting and business flight hours and miles to compute Internal Revenue Code Section 280F Qualified Business Use percentages, Standard industry fare level (SIFL) imputed income amounts for personal use flights, IRC Section 274 entertainment and commuting expense disallowance amounts and SEC Incremental Costs for reporting for named executive officers. Track Internal Revenue Code Section 280F Qualified Business Use percentage thresholds which must be met or exceeded in the year of purchase to obtain bonus depreciation and to use accelerated depreciation methods, and must be met or exceeded in subsequent years to avoid depreciation recapture. Multi-leg entertainment flight tracking and calculation option included. Repositioning flights tracked. Complete flight package for tax and SEC Aircraft tracking and compliance reporting. Download logs for audit purposes and records.

Both Web based and MacOS/iOS versions available. All versions (web, Mac, iPhone and iPad) available with a single subscription. Download on the Mac App Store , on the iOS-iPhone App Store or signup for the web version. Sixty-day free trial available (no credit card or commitment required).

* AircraftTaxSolutions.com does not provide tax, legal or accounting advice. These materials have been prepared for informational purposes only, and are not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.