Standard Industry Fare Level or SIFL Formula Calculations

SIFL Basics

Internal Revenue Code Section 61(a)(1) provides that, except as otherwise provided in subtitle A of the Internal Revenue Code of 1986, gross income includes compensation for services, including fees, commissions, fringe benefits, and similar items. Examples of fringe benefits include: an employer-provided automobile, a flight on an employer-provided aircraft, an employer-provided free or discounted commercial airline flight, an employer-provided vacation, an employer-provided discount on property or services, an employer-provided membership in a country club or other social club, and an employer-provided ticket to an entertainment or sporting event. Hence, if an employer permits an officer, employee or other service provider to use the employer's aircraft for a personal flight (and the flight crew, including pilots, is provided), the value of that flight must be included in the individual's gross income for the applicable tax year (to the extent that there is no reimbursement). The regulations under Internal Revenue Code Section 61 provide that these income imputation rules apply to all service providers, even if not common law employees. See Treas. Reg. § 1.61-21(a)(4)(ii) ("The person to whom a fringe benefit is taxable need not be an employee of the provider of the fringe benefit, but may be, for example, a partner, director, or an independent contractor.").

If the true fair market value of a personal flight on an employer provided aircraft was imputed as income to an employee, such amount could be significant, particularly when higher end corporate jets are involved. As a general rule, the amount of income imputed is equal to the cost to charter a comparable flight. Treas. Reg. § 1.61-21(b)(6). However, the IRS' regulations provide for an alternative approach for determining the amount of income that must be imputed, which in most cases results in a lower amount of income being imputed (unless the individual is a senior executive and travels with a large number of family members or other guests). The regulations permit income to be alternatively imputed using the non-commercial flight valuation or SIFL formula rules which use the flight miles, aircraft multiple (based on aircraft maximum takeoff weight), SIFL rates and terminal charge (published for the six-month period during which the flight occurred) and employee status (control vs. non-control employee) to calculate the imputed income amount. Treas. Reg. § 1.61-21(g). The tax advantages associated with the lower amount of income imputed under the SIFL rules has drawn the attention of lawmakers who have suggested (in a letter to the IRS and U.S. Department of Treasury) repealing the use of the SIFL Formula rules (instead requiring the imputation of income based on the fair market value of the flight)

The U.S. Department of Transportation publishes SIFL rates for each six-month period (January 1 - June 30 and July 1 - December 31). These rates are used to determine the imputed tax value of non-business or personal travel aboard employer-provided aircraft under Internal Revenue Service Regulation Section 1.61-21(g). The SIFL amount is determined on a per-flight, per-person basis and generally is reported for tax purposes to the responsible employee or other person on IRS Form W-2 (employees), Form 1099 (independent contractors) or Schedule K-1 (partners) each taxable year. The value of a flight determined under the SIFL formula involves multiplying (1) the SIFL cents-per-mile rates applicable for the 6 month period during which the flight was taken by (2) the appropriate aircraft multiple provided in Treasury Regulation Section 1.61-21(g)(7) and (3) the miles (statute not nautical) between airports and (4) then adding the applicable terminal charge. If you need to determine the statute miles between 2 airports, this can be calculated using our distance calculator. Note that a statute mile is 5,280 feet in length whereas a nautical mile is 6,076.11549 feet in length. If your aircraft logs reflect nautical miles, you will need to convert them to statute miles to compute the SIFL amount for a flight using those records. The examples in the IRS regulations use the distance between airports suggesting that an employer use the miles between airports and not the actual miles flown in computing the SIFL amount for a flight. See Treas. Reg. § 1.61-21(g)(3)(iv), Examples 1 and 2.

The SIFL valuation rule may be used to value international as well as domestic flights. Under the SIFL valuation rules, the SIFL value is determined separately for each flight. Thus, a round-trip is comprised of at least two flights. For example, an employee who takes a personal trip on an employer-provided aircraft from New York City to Denver, then Denver to Los Angeles, and finally Los Angeles to New York City has taken three flights and must apply the SIFL aircraft valuation formula separately to each flight. If a landing is necessitated by weather conditions, by an emergency, for purposes of refueling or obtaining other services relating to the aircraft or for any other purpose unrelated to the personal purposes of the employee whose flight is being valued, that landing is an intermediate stop. Additional mileage attributable to an intermediate stop is not considered when determining the distance of an employee's flight. The SIFL valuation rules may not be used to value a flight on any commercial aircraft on which air transportation is sold to the public on a per-seat basis (commercial airlines). The SIFL valuation rule may be used for flights on owned, chartered, leased and fractionally owned aircraft. The SIFL valuation rule only applies on employer provided flights; in the case of aircraft owned by a person (either directly or through a wholly owned entity (LLC, trust, etc...)), any personal use is not a fringe benefit and instead all deductions are simply disallowed for the personal use.

What are the applicable Standard Industry Fare Level ("SIFL") Rates and Terminal Charges?

Standard Industry Fare Level or SIFL rates and terminal charges are published twice per year. The AircraftTaxSolutions.com software automatically applies the correct SIFL rates and terminal charge for each flight and passenger entered (using the lowest rates permitted). For reference, attached are links to the semi-annual SIFL rates and terminal charges for recent periods:

- Historical and Current SIFL Rates from 1979 through December 31, 2025

- Rev. Rul. 2021-11 (SIFL Rates for January 1, 2021 -- June 30, 2021)

- Rev. Rul. 2021-19 (SIFL Rates for July 31, 2021 -- December 31, 2021)

- Rev. Rul. 2022-12 (SIFL Rates for January 1, 2022 -- June 30, 2022)

- Rev. Rul. 2022-19 (SIFL Rates for July 31, 2022 -- December 31, 2022)

- Rev. Rul. 2023-7 (SIFL Rates for January 1, 2023 -- June 30, 2023)

- Rev. Rul. 2023-19 (SIFL Rates for July 1, 2023 -- December 31, 2023)

SIFL Aircraft Multiples

The proscribed SIFL Aircraft Multiples are set forth in the table below:

SIFL Aircraft Multiples |

||

|---|---|---|

| Maximum Certified Take-off Weight | Aircraft Multiple for a Control Employee | Aircraft Multiple for a Non-Control Employee |

| 6,000 lbs. or less | 62.5% | 15.6% |

| 6,001 lbs. to 10,000 lbs. | 125% | 23.4% |

| 10,001 lbs. to 25,000 lbs. | 300% | 31.3% |

| 25,001 lbs. or greater | 400% | 31.3% |

Who is a SIFL Control Employee?

For this purpose, a SIFL "control employee" of a non-government employer is any employee - (A) Who is a Board- or shareholder-appointed, confirmed, or elected officer of the employer, limited to the lesser of - (1) One percent of all employees (increased to the next highest integer, if not an integer) or (2) Ten employees; (B) Who is among the top one percent most highly-paid employees of the employer (increased to the next highest integer, if not an integer) limited to a maximum of 50; (C) Who owns a five-percent or greater equity, capital, or profits interest in the employer; or (D) Who is a director of the employer. Any employee who is a family member of a control employee is also treated as a control employee. For more details on the definition of a SIFL control employee, see Treasury Regulation § 1.61-21(g). In general, an employee who is not a 5% owner nor a director and whose compensation is less than $50,000 will not be treated as a control employee. An employee who was a control employee of the employer at any time after reaching age 55, or within three years of separation from the service of the employer, is a control employee with respect to flights taken after separation from the service of the employer.

Any flight provided to an individual whose flight would be taxable to a control employee as the recipient shall be valued as if such flight had been provided to that control employee. For example, assume that the chief executive officer of an employer, his or her spouse, and his or her two children fly on an employer-provided aircraft for personal purposes, all 4 flights shall be valued using the control employee multiple and attributed to the executive. Also, note that persons under age two are not counted for SIFL purposes. Treas. Reg. § 1.61-21(g)(1).

Person To Whom is SIFL Imputed?

A taxable fringe benefit is included in the income of the person performing the services in connection with which the fringe benefit (for example, an employer provided non-business flight) is furnished. Thus, a fringe benefit may be taxable to a person even though that person did not actually receive the fringe benefit. For example, if a non-business flight is furnished to someone other than the service provider such benefit is considered as furnished to the service provider, and use by the other person is considered use by the service provider. For example, the provision of flight by a company to an employee's or independent contractor's spouse in connection with the performance of services by the employee or independent contractor is taxable to the employee or independent contractor, as applicable (and SIFL income is reported to such service provider). See Treas. Reg. § 1.61-21(a)(4).

Special Rules for Employees Where Security Related Concerns Exist

Under Treasury Regulation Section 1.132-5, if a bona fide business-oriented security concern is properly established justifying private aircraft travel, then the aircraft multiple used in the SIFL calculation will not exceed 200% (which on larger aircraft can otherwise be as high as 300% or 400%). See PLR 200705010. A bona fide business-oriented security concern exists for a specific employee only if the facts and circumstances establish a specific basis for concern for the safety of the particular employee. A generalized concern for an employee's safety is not a bona fide business-oriented security concern. To qualify under this special rule, an employer must establish an overall security program for the employee providing for, among other things, 24-hour a day, 7 day a week protection. Alternatively, the employer may have an independent security study prepared by a professional security firm that provides other specific security recommendations (i.e., not 24-hour a day, 7 day a week security protection but some lesser and/or other level of protection which includes private air travel) and is deemed to be an overall security program. An independent security study must meet the following requirements to be deemed an overall security program (when a 24-hour a day, 7 day a week security program is not needed):

- The study must be performed for the employer and the employee by an independent security consultant;

- The study must be based on an objective assessment of all facts and circumstances;

- The study must recommend that an overall security program is not necessary, and that the recommendation is reasonable under the circumstances; and

- The employer must apply the specific security recommendations to the employee on a consistent basis.

SIFL Example Calculations.

Some examples may be helpful.

Example 1 (personal flight for one control employee). Assume that an employee (that is a control employee) flew from New York to Miami for a vacation on the employer's G500 in the first six months of 2022. Assume it is a 2 hour flight and the average hourly charter rate for a comparable jet is $9,000 per hour. In that case, using normal charter rate rules, the employee would be imputed $18,000 in income each way (2 hours x $9,000 per hour) or $36,000 round trip. Under the SIFL rules, the imputed amount would be only $744.61 per person each way (1,300 miles each way multiplied by the lowest applicable SIFL rate and the control multiple (4x) plus a terminal charge of $29.45) or $1,489.22 round trip. In this situation, use of the SIFL rules to impute income results in a dramatically lower income imputation to the executive than using the market charter rate. You can confirm those numbers in the SIFL Calculator provided below or run the SIFL calculations on your own flights.

Example 2 (business flight for control employee with spouse and 2 children). Assume that the children are over the age of two (2); otherwise, there is no SIFL imputed income for children under the age of 2. Assume a trip from Atlanta (ATL) to Teterboro, NJ (TEB) on an employer provided G650 in the second half of 2023. Here, there would be no SIFL imputed income charge for the control employee on the assumption he or she is traveling on business. IRC § 132(d). However, there is a SIFL imputed income charge for each of the 3 other passengers. They are guests of the executive so the SIFL income associated with those individuals is imputed to and reported by the executive and they are treated as control employees. Treas. Reg. § 1.61-21(g)(7)(ii). The flight is 757 statute miles (Distance Calculator) and therefore the SIFL imputed income amount is $859.77 per person (400% multiple x (($0.2898 * 500 miles) + ($0.2210 * 257 miles)) + $52.98 terminal charge) or $2,579.31 total. Assuming the charter rate of $12,000 per hour and assuming the flight was 1.5 hours each way, the imputed income cost to the executive is substantially lower using the SIFL formula to impute income than using the market charter rate. You can confirm the SIFL numbers in the SIFL Calculator provided below.

Example 3 (50%+ business passengers; control employee and guest). Assume that more than 50% of the regular passenger seats on a G550 are occupied by business passengers on a flight from Teterboro, NJ (TEB) to Los Angeles, CA (LAX) in the second half of 2023. Under the 50% seating capacity rule, the personal flight for the control employee is zero. However, such person's guest (assuming not a spouse or child of the control employee who invited the guest) is subject to income imputation to the employee who invited such passenger. While normally, income would be imputed under the SIFL rule using the control employee's multiple (400% here), because of the special 50% seating capacity rule, the non-control person multiple (31.3%) is permitted to be used. This results in a SIFL income charge for the 2,459 statute mile flight of only $231.26 (31.3% multiple x (($0.2898 * 500 miles) + ($0.2210 * 1,000 miles) + ($0.2124 * 959 miles)) + $52.98 terminal charge).

Example 4 (Mixed Purpose -- Primarily Business). If an executive (assume a control employee) flies from Teterboro, NJ (TEB) to Tampa, FL (TPA) for business on the company's G550, then files to Miami, FL (MIA) for a personal event and then returns to Teterboro, NJ, the SIFL amount to be imputed is the SIFL value for all three flight legs ($1,083.07 (TEB-TPA), $289.80 (TPA-MIA), $1,160.95 (MIA-TEB)) in excess of the SIFL value for flight from Teterboro, NJ to Tampa, FL and directly back to Teterboro, NJ ($1,083.07 x 2). This results in a SIFL imputed income amount of $367.69. This assumes the primary purpose of the trip was for business purposes.

Example 5 (Mixed Purpose -- Primarily Personal). If an executive (assume a control employee) flies from Teterboro, NJ (TEB) to Tampa, FL (TPA) for business on the company's G550, then files to Miami, FL (MIA) for a personal event and then returns to Teterboro, NJ, the SIFL amount to be imputed is the SIFL value of a flight from Teterboro, NJ to Miami, FL and then directly back to Teterboro, NJ (SIFL amount each way is $1,160.95). This results in a SIFL imputed income amount of $2,321.89. This assumes the primary purpose of the trip was for personal purposes.

Example 6 (Foreign Travel -- Business and Personal Days). If an executive (assume a control employee) flies from Miami, FL (MIA) to London, Heathrow (LHR) for business purposes on the company's G650. Assume that the executive departs on Monday, August 7, 2023 and returns on Friday, August 18, 2023. Assume the executive has business meetings on Tuesday, August 8th, Wednesday, August 9th and Monday, August 14th. Under the Internal Revenue Code Section 274 Regulations, travel days as well as weekends and holidays are generally treated as business days (except for purposes of the 7 day test (for which only the return date is counted)). Hence, the executive is traveling for 7 business days (2 travel days, 3 meeting days, 2 intervening weekend days) and 5 personal days. Because the executive is outside the United States for more than 1 week and personal days equal or exceed more than 25% of the total trip days, Section 274(c) applies. Consequently, the SIFL imputed income amount is determined by dividing the total number of personal days outside the U.S. (5 in this example) by the total number of foreign travel days (12 in this example) and multiplying that amount by the SIFL Amount determined as if the entire trip was a personal trip ($3,994.87 x 2 = $7,989.74). This results in a SIFL imputed income amount of $3,329.06 for this executive.

Each Flight Leg Must Be Tracked and Evaluated Separately

Each flight leg where a passenger boards and deplanes must be separately determined under the SIFL rules, although intermediate stops to refuel, for weather issues or other emergencies are ignored. Treas. Reg. § 1.61-21(g)(3). If an employee combines, in one trip, personal and business flights on an employer-provided aircraft and the trip is primarily for the employer's business, the imputed SIFL income is the excess of the SIFL value of all the flights that comprise the trip over the SIFL value of the flights that would have been taken had there been no personal flights but only business flights. For example, assume that an employee flies on an employer-provided aircraft from Chicago, Illinois, to Miami, Florida, for the employer's business and then from Miami, the employee flies on the employer-provided aircraft to Orlando, Florida, for personal purposes and then flies back to Chicago. If the primary purpose of the trip is for the employer's business, the amount includible in income is the excess of the value of the three flights (Chicago to Miami, Miami to Orlando, and Orlando to Chicago), over the value of the flights that would have been taken had there been no personal flights but only business flights (Chicago to Miami and Miami to Chicago). If an employee combines, in one trip, personal and business flights on an employer-provided aircraft and the employee's trip is primarily personal, the SIFL amount includible in the employee's income is the SIFL value of the personal flights that would have been taken had there been no business flights but only personal flights. For example, assume that an employee flies on an employer-provided aircraft from San Francisco, California, to Los Angeles, California, for the employer's business and that from Los Angeles the employee flies on an employer-provided aircraft to Palm Springs, California, primarily for personal reasons and then flies back to San Francisco. Assume further that the primary purpose of the trip is personal. The amount includible in the employee's income is the value of personal flights that would have been taken had there been no business flights but only personal flights (San Francisco to Palm Springs and Palm Springs to San Francisco). The SIFL Calculator below includes options to account for mixed purpose trips.

Special rule where 50% of seats are occupied by Business Passengers.

There is a special rule that is applicable if at least 50% of the regular passenger seating capacity on a flight is occupied by business passengers. In that case, there is no SIFL charge for employees (but not directors or independent contractors) and their spouses and children traveling for personal purposes. Treas. Reg. § 1.61-21(g)(12). In the case of other passengers (that is passengers other than an employee, spouse or children) traveling for personal purposes, SIFL income is still imputed, but using the non-control multiple. Treas. Reg. § 1.61-21(g)(12)(B)(1). This special rule applies only if the seating capacity rule is met both at the time the individual whose flight is being valued boards the aircraft and at the time the individual deplanes. Consequently, if there are stops where passengers board and deplane, the changing composition of the passengers must be considered. When determining the regular passenger seating capacity of an aircraft, any seat occupied by a member of the flight crew (whether or not such individual is an employee of the employer providing the aircraft) shall not be counted, unless the purpose of the flight by such individual is not primarily to serve as a member of the flight crew.

Rules for Withholding, Depositing, and Reporting

Generally, you must determine the value of taxable noncash fringe benefits (such as SIFL imputed income for personal flights on employer aircraft) no later than January 31 of the subsequent year. See IRS Publication 15-B, Employer's Tax Guide to Fringe Benefits. Before January 31, the IRS rules permit an employer to reasonably estimate the value of the fringe benefits for purposes of withholding and depositing on time. For employment tax and withholding purposes, an employer is permitted to treat taxable noncash fringe benefits (including personal use of employer-provided aircraft) as paid on a pay period, quarter, semiannual, annual, or other basis. But the benefits must be treated as paid no less frequently than annually. An employer is not required to choose the same period for all employees. An employer can withhold more frequently for some employees than for others. There is some authority which indicates that fringe benefits provided in November and December of a given year may be treated as provided in the subsequent tax year. IRS Notice 2005-45; Ann. 85-113, 1985-31 IRB 31; Treas. Reg. § 1.61-21(c)(7). It is unclear how deferring the reporting and taxation of fringe benefits provided in November and December may impact the timing of any associated tax deductions.

You must login to use this feature.

If you do not have a free 60 day trial (no credit card or commitment required), please sign up now for a free trial to use this feature.

Section 274(c) International Travel SIFL Calculator.

Special rules can apply in the case of international travel outside the United States. A discussion of these rules is provided below in the Section entitled International Trips Subject to IRC Section 274(c). The Section 274(c) International Travel SIFL Calculator can be used to determine the applicable SIFL amount for any international trips taking into account these special rules.

You must login to use this feature.

If you do not have a regular subscription or a free 60 day trial (no credit card or commitment required), please sign up now for a free trial to use this feature.

SIFL Calculator for Multi-leg Mixed Purpose (personal and non-personal) Trips.

Regulations under Section 1.61-21(g) contain special rules when an employee combines, in one trip, personal and business flights on an employer-provided aircraft. Different calculations apply if the primary purpose of the trip is business or personal. See Regulation § 1.61-21(g). The regulations provide if an employee combines, in one trip, personal and business flights on an employer-provided aircraft and the employee's trip is primarily for the employer's business (see § 1.162-2(b)(2)), the employee must include in income the excess of the value of all the flights that comprise the trip over the value of the flights that would have been taken had there been no personal flights but only business flights. By contrast, if an employee combines, in one trip, personal and business flights on an employer-provided aircraft and the employee's trip is primarily personal (see § 1.162-2(b)(2)), the amount includible in the employee's income is the value of the personal flights that would have been taken had there been no business flights but only personal flights. Please note that for purposes of the calculator, if the primary purpose of the trip is personal, the final leg of any trip can be labeled as personal or business; the SIFL imputation will be the same in either instance.

You must login to use this feature.

If you do not have a regular subscription or a free 60 day trial (no credit card or commitment required), please sign up now for a free trial to use this feature.

Penalties for SIFL Errors

If an employer or other service recipient desires to use the SIFL rules to reflect personal aircraft use for employees and other service providers, it is important that the SIFL rules be properly applied and administered. If it is later determined that there are errors, the IRS can (a) require the imputation of income to employees and service providers at the charter rate (likely higher) in lieu of the SIFL imputed income amount and (b) potentially disallow part or all of the owner's associated deductions. See Treas. Reg. § 1.61-21(c)(5), (g)(13); IRC § 274(e); Treas. Reg. § 1.162-25T. Recently, the IRS has announced an initiative to audit aircraft usage by large corporations, large partnerships and high-income taxpayers to try to determine whether for tax purposes the use of such aircraft is being properly allocated between business and personal uses and whether SIFL (or charter rate) income is being imputed for personal use flights. See IRS Notice on Aircraft Audits.

Empty, Repositioning and Deadhead Flights

The SIFL rules do not require any additional imputed income for any empty, repositioning or deadhead flights necessitated by a personal flight. This is in contrast to other rules such as the Internal Revenue Code Section 274 entertainment and commuting disallowance rules which have specific rules requiring that miles and flight hours attributable to deadhead, empty or repositioning flights be counted in the determinations.

International Trips Subject to IRC Section 274(c)

Internal Revenue Code Section 274(c) provides that in the case of any individual who travels outside the United States away from home in pursuit of a trade or business or an investment activity, no deduction shall be allowed for the non-business portion of the trip and special SIFL income imputation rules apply for employer provided flights that have non-business days. These special rules do not apply if any travel outside the United States does not exceed one week, or the portion of the time of travel outside the United States which is not attributable to the pursuit of the taxpayer’s trade or business or investment activity is less than 25 percent of the total time on such travel. For purposes of determining whether a trip outside the United States exceeds one week, the day in which travel outside the United States begins shall not be considered, but the day in which such travel ends shall be considered. In counting days for purposes of 25 percent test, travel days to and from the U.S. are considered business days. Treas. Reg. § 1.274-4(d)(2). Moreover, any day that the taxpayer’s presence is required for business reasons at the foreign location is considered a business day. Weekends and holidays are also generally counted as business days if the days arise between business days. If Section 274(c) applies, the SIFL imputed income amount for any employer provided flights on the trip is determined by dividing the total number of personal days outside the U.S. by the total number of foreign travel days and multiplying that amount by the SIFL Amount determined as if the entire trip was a personal trip. See Treas. Reg. § 1.61-21(g)(4)(iv). It should be noted that SIFL imputed income is only required where the flight is provided by an employer or other service recipient; if the aircraft is owned by the individual in lieu of SIFL income imputation, the rule disallows some or all of the expenses associated with the flight. Treas. Reg. § 1.274-4(a) (expense disallowance rule does not apply to an employer provided flight.). Lastly, these special rules only apply if the primary purpose of the trip was business; if the primary purpose of the trip was personal, then SIFL income is imputed under the regular rules.

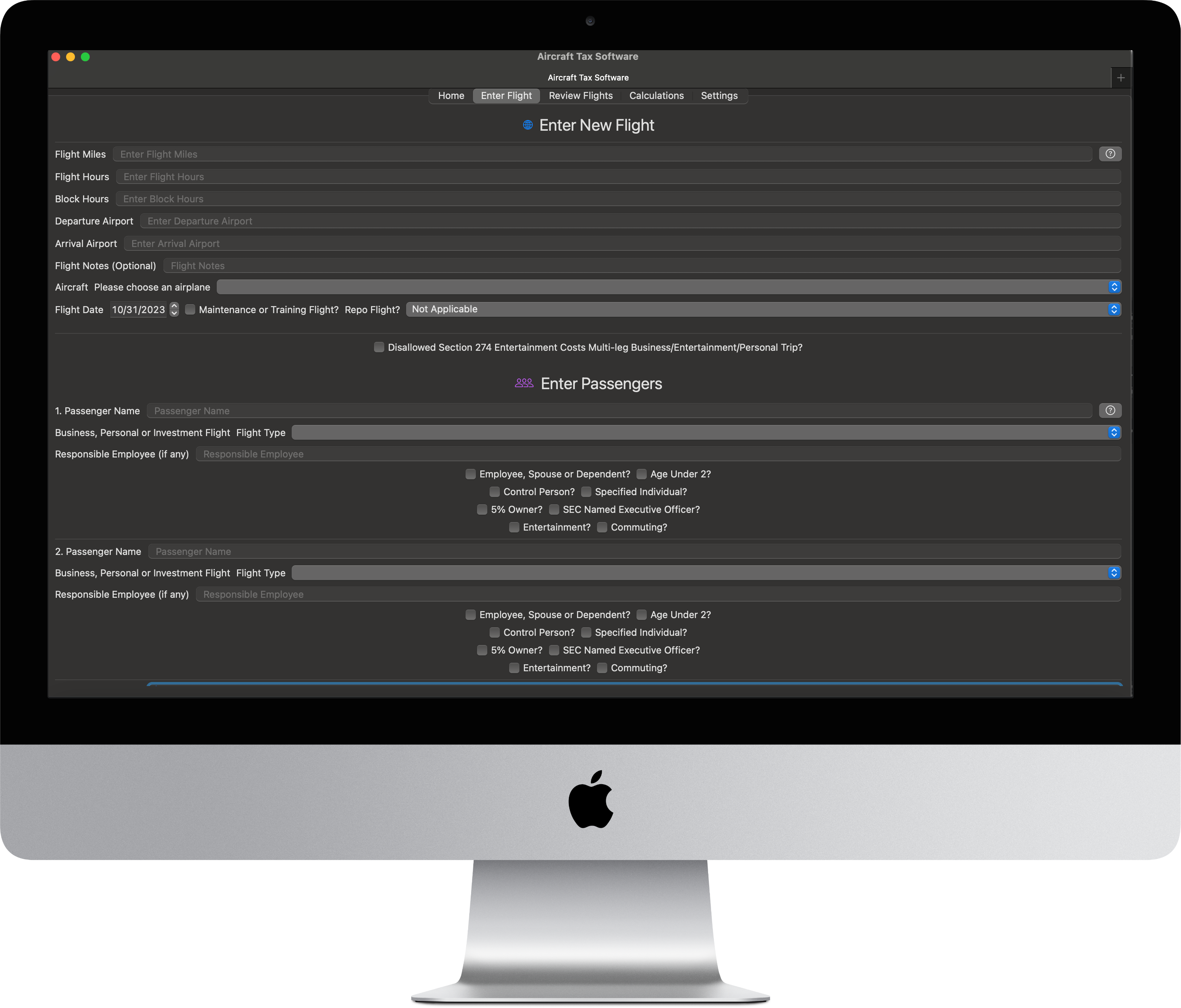

Simplify Your Aircraft Tax Compliance

Don't rely on inadequate records or error prone spreadsheets. Use the Aircraft Tax Software App to track SIFL income and personal, entertainment, commuting and business flight hours and miles.

Sign up for a free 60-day trial and start tracking today.

Sign Up For Free 60 Day Aircraft Tax Software Trial.

Sign up for a 60-day free trial of the AircraftTaxSolutions.com Aircraft Tax Software to track personal, entertainment, commuting and business flight hours and miles to compute Internal Revenue Code Section 280F Qualified Business Use percentages, Standard industry fare level (SIFL) imputed income amounts for personal use flights, IRC Section 274 entertainment and commuting expense disallowance amounts and SEC Incremental Costs for reporting for named executive officers. Track Internal Revenue Code Section 280F Qualified Business Use percentage thresholds which must be met or exceeded in the year of purchase to obtain bonus depreciation and to use accelerated depreciation methods, and must be met or exceeded in subsequent years to avoid depreciation recapture. Multi-leg entertainment flight tracking and calculation option included. Repositioning flights tracked. Complete flight package for tax and SEC Aircraft tracking and compliance reporting. Download logs for audit purposes and records. No credit card or commitment needed for 60-day free trial. Request a software demo as well.

Both Web based and MacOS/iOS versions available. All versions (web, Mac, iPhone and iPad) available with a single subscription. Download on the Mac App Store , on the iOS-iPhone App Store or signup for the web version. Sixty-day free trial available (no credit card or commitment required).

* AircraftTaxSolutions.com does not provide tax, legal or accounting advice. These materials have been prepared for informational purposes only, and are not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Standard Industry Fare Level or SIFL

SIFL Basics

Internal Revenue Code Section 61(a)(1) provides that, except as otherwise provided in subtitle A of the Internal Revenue Code of 1986, gross income includes compensation for services, including fees, commissions, fringe benefits, and similar items. Examples of fringe benefits include: an employer-provided automobile, a flight on an employer-provided aircraft, an employer-provided free or discounted commercial airline flight, an employer-provided vacation, an employer-provided discount on property or services, an employer-provided membership in a country club or other social club, and an employer-provided ticket to an entertainment or sporting event. Hence, if an employer permits an officer, employee or other service provider to use the employer's aircraft for a personal flight (and the flight crew, including pilots, is provided), the value of that flight must be included in the individual's gross income for the applicable tax year (to the extent that there is no reimbursement). The regulations under Internal Revenue Code Section 61 provide that these income imputation rules apply to all service providers, even if not common law employees. See Treas. Reg. § 1.61-21(a)(4)(ii) ("The person to whom a fringe benefit is taxable need not be an employee of the provider of the fringe benefit, but may be, for example, a partner, director, or an independent contractor.").

The U.S. Department of Transportation publishes SIFL rates for each six-month period (January 1 - June 30 and July 1 - December 31). These rates are used to determine the imputed tax value of non-business or personal travel aboard employer-provided aircraft under Internal Revenue Service Regulation Section 1.61-21(g). The SIFL amount is determined on a per-flight, per-person basis and generally is reported for tax purposes to the responsible employee or other person on IRS Form W-2 (employees), Form 1099 (independent contractors) or Schedule K-1 (partners) each taxable year. The value of a flight determined under the SIFL formula involves multiplying (1) the SIFL cents-per-mile rates applicable for the 6 month period during which the flight was taken by (2) the appropriate aircraft multiple provided in Treasury Regulation Section 1.61-21(g)(7) and (3) the miles (statute not nautical) between airports and (4) then adding the applicable terminal charge. If you need to determine the statute miles between 2 airports, this can be calculated using our distance calculator. Note that a statute mile is 5,280 feet in length whereas a nautical mile is 6,076.11549 feet in length. If your aircraft logs reflect nautical miles, you will need to convert them to statute miles to compute the SIFL amount for a flight using those records. The examples in the IRS regulations use the distance between airports suggesting that an employer use the miles between airports and not the actual miles flown in computing the SIFL amount for a flight. See Treas. Reg. § 1.61-21(g)(3)(iv), Examples 1 and 2.

The SIFL valuation rule may be used to value international as well as domestic flights. Under the SIFL valuation rules, the SIFL value is determined separately for each flight. Thus, a round-trip is comprised of at least two flights. For example, an employee who takes a personal trip on an employer-provided aircraft from New York City to Denver, then Denver to Los Angeles, and finally Los Angeles to New York City has taken three flights and must apply the SIFL aircraft valuation formula separately to each flight. If a landing is necessitated by weather conditions, by an emergency, for purposes of refueling or obtaining other services relating to the aircraft or for any other purpose unrelated to the personal purposes of the employee whose flight is being valued, that landing is an intermediate stop. Additional mileage attributable to an intermediate stop is not considered when determining the distance of an employee's flight. The SIFL valuation rules may not be used to value a flight on any commercial aircraft on which air transportation is sold to the public on a per-seat basis (commercial airlines). The SIFL valuation rule may be used for flights on owned, chartered, leased and fractionally owned aircraft. The SIFL valuation rule only applies on employer provided flights; in the case of aircraft owned by a person (either directly or through a wholly owned entity (LLC, trust, etc...)), any personal use is not a fringe benefit and instead all deductions are simply disallowed for the personal use.

Who is a SIFL Control Employee?

For this purpose, a SIFL "control employee" of a non-government employer is any employee - (A) Who is a Board- or shareholder-appointed, confirmed, or elected officer of the employer, limited to the lesser of - (1) One percent of all employees (increased to the next highest integer, if not an integer) or (2) Ten employees; (B) Who is among the top one percent most highly-paid employees of the employer (increased to the next highest integer, if not an integer) limited to a maximum of 50; (C) Who owns a five-percent or greater equity, capital, or profits interest in the employer; or (D) Who is a director of the employer. Any employee who is a family member of a control employee is also treated as a control employee. For more details on the definition of a SIFL control employee, see Treasury Regulation § 1.61-21(g). Further, any employee who is a family member of a control employee is also a control employee. In general, an employee who is not a 5% owner nor a director and whose compensation is less than $50,000 will not be treated as a control employee. An employee who was a control employee of the employer at any time after reaching age 55, or within three years of separation from the service of the employer, is a control employee with respect to flights taken after separation from the service of the employer.

Each Flight Leg Must Be Tracked and Evaluated Separately

Each flight leg where a passenger boards and deplanes must be separately determined under the SIFL rules, although intermediate stops to refuel, for weather issues or other emergencies are ignored. Treas. Reg. § 1.61-21(g)(3). If an employee combines, in one trip, personal and business flights on an employer-provided aircraft and the trip is primarily for the employer's business, the imputed SIFL income is the excess of the SIFL value of all the flights that comprise the trip over the SIFL value of the flights that would have been taken had there been no personal flights but only business flights. For example, assume that an employee flies on an employer-provided aircraft from Chicago, Illinois, to Miami, Florida, for the employer's business and then from Miami, the employee flies on the employer-provided aircraft to Orlando, Florida, for personal purposes and then flies back to Chicago. If the primary purpose of the trip is for the employer's business, the amount includible in income is the excess of the value of the three flights (Chicago to Miami, Miami to Orlando, and Orlando to Chicago), over the value of the flights that would have been taken had there been no personal flights but only business flights (Chicago to Miami and Miami to Chicago). If an employee combines, in one trip, personal and business flights on an employer-provided aircraft and the employee's trip is primarily personal, the SIFL amount includible in the employee's income is the SIFL value of the personal flights that would have been taken had there been no business flights but only personal flights. For example, assume that an employee flies on an employer-provided aircraft from San Francisco, California, to Los Angeles, California, for the employer's business and that from Los Angeles the employee flies on an employer-provided aircraft to Palm Springs, California, primarily for personal reasons and then flies back to San Francisco. Assume further that the primary purpose of the trip is personal. The amount includible in the employee's income is the value of personal flights that would have been taken had there been no business flights but only personal flights (San Francisco to Palm Springs and Palm Springs to San Francisco). The SIFL Calculator below includes options to account for mixed purpose trips.

Special rule where 50% of seats are occupied by Business Passengers.

There is a special rule that is applicable if at least 50% of the regular passenger seating capacity on a flight is occupied by business passengers. In that case, there is no SIFL charge for employees (but not directors or independent contractors) and their spouses and children traveling for personal purposes. Treas. Reg. § 1.61-21(a)(4). In the case of other passengers (that is passengers other than an employee, spouse or children) traveling for personal purposes, SIFL income is still imputed, but using the non-control multiple. Treas. Reg. § 1.61-21(g)(12)(B)(1). This special rule applies only if the seating capacity rule is met both at the time the individual whose flight is being valued boards the aircraft and at the time the individual deplanes. Consequently, if there are stops where passengers board and deplane, the changing composition of the passengers must be considered. When determining the regular passenger seating capacity of an aircraft, any seat occupied by a member of the flight crew (whether or not such individual is an employee of the employer providing the aircraft) shall not be counted, unless the purpose of the flight by such individual is not primarily to serve as a member of the flight crew.

Establishing a bona fide business-oriented security concern.

Under Treasury Regulation Section 1.132-5, a bona fide business-oriented security concern exists for a specific employee only if the facts and circumstances establish a specific basis for concern for the safety of the particular employee. A generalized concern for an employee's safety is not a bona fide business-oriented security concern. An employer must establish an overall security program for the employee providing 24-hour a day, 7 day a week protection. Alternatively, the employer may have an independent security study prepared that provides other specific security recommendations (i.e., not 24-hour a day, 7 day a week security protection) and is deemed to be an overall security program. An independent security study must meet the following requirements to be deemed an overall security program (when a 24-hour a day, 7 day a week security program is not needed):

- The study must be performed for the employer and the employee by an independent security consultant;

- The study must be based on an objective assessment of all facts and circumstances;

- The study must recommend that an overall security program is not necessary, and that the recommendation is reasonable under the circumstances; and

- The employer must apply the specific security recommendations to the employee on a consistent basis.