Individual and Enterprise (family office, accounting firms, etc..) subscriptions.

Complete software flight package for tax and SEC tracking and reporting. Various pricing options. Both Web based and MacOS/iOS versions available. All versions (web, Mac, iPhone and iPad) available with a single subscription.

Sign up for a free 60 day trial. No credit card required.

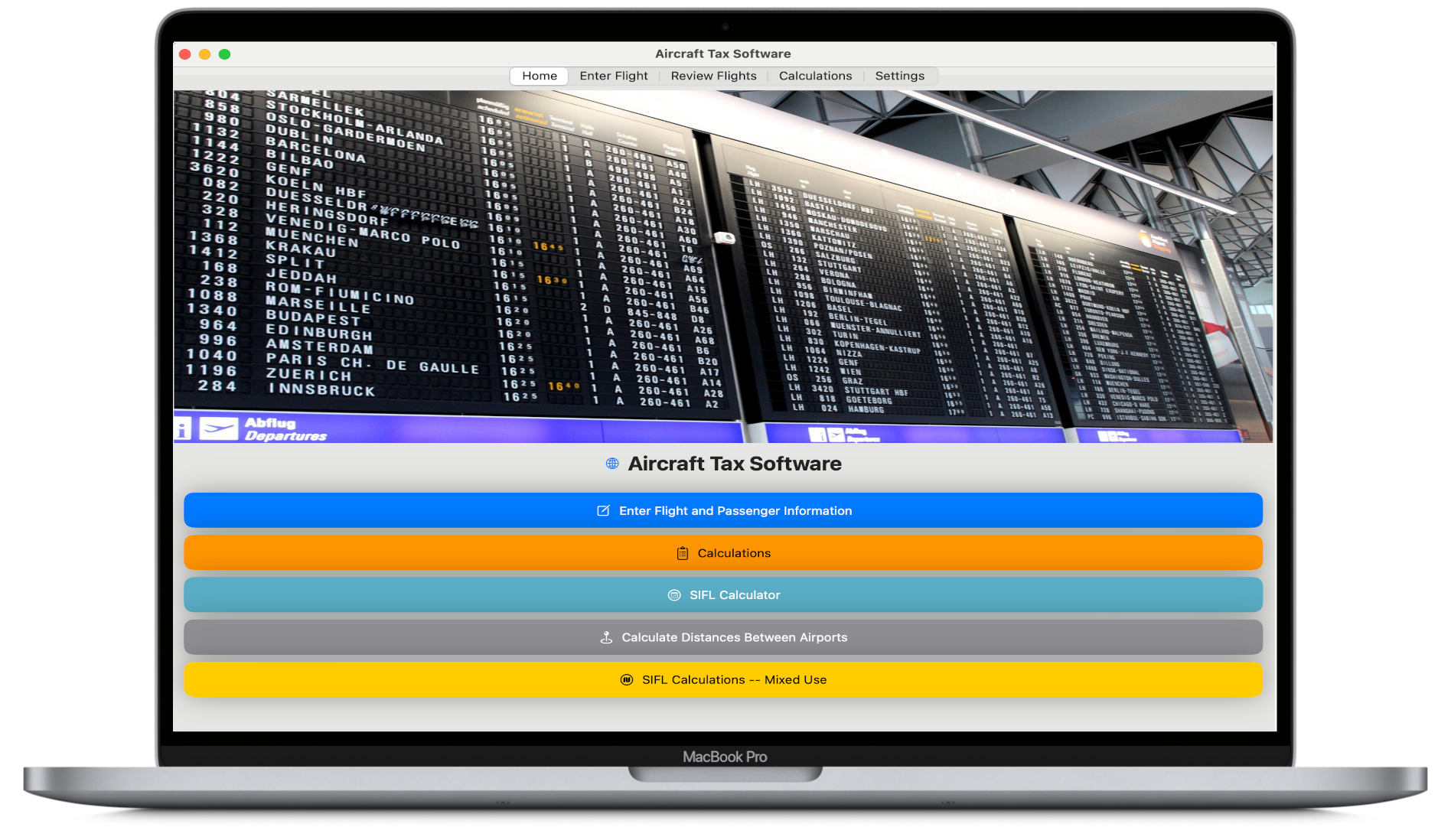

MacOS and iOS Versions Available.

All the features available with the individual web based version but designed and optimized for MacOS. Download on the Mac App Store . iOS version also available on the iOS-iPhone App Store .

SIFL and SEC Incremental Costs

Track and report SIFL imputed income and SEC incremental cost amounts for personal flights on employer provided aircraft. SIFL amounts computed for mixed-purpose flights and international travel. Advanced SIFL Calculators. Detailed reports.

Qualified Business Use

Track IRC Section 280F Qualified Business Use percentages. Calculate using Flight by Flight Hours and Miles and Occupied Seat Hours and Miles approaches. Mixed use trips, maintenance and training flights and empty, repositioning and deadhead flights tracked.

Entertainment and Commuting Disallowance

Track personal, entertainment, commuting and business flight hours and miles to compute IRC Section 274 entertainment and commuting expense disallowance amounts.